In the realm of digital finance, managing and improving customer-facing platforms, like websites and apps, can often be challenging due to their complex nature and the constantly changing backends and business needs. Microservice architecture is a promising solution that's reimagining the way we develop and maintain these tools. The Microservice term covers several topics, for this article we will go into micro-frontends specifically.

What is a microservice architecture?

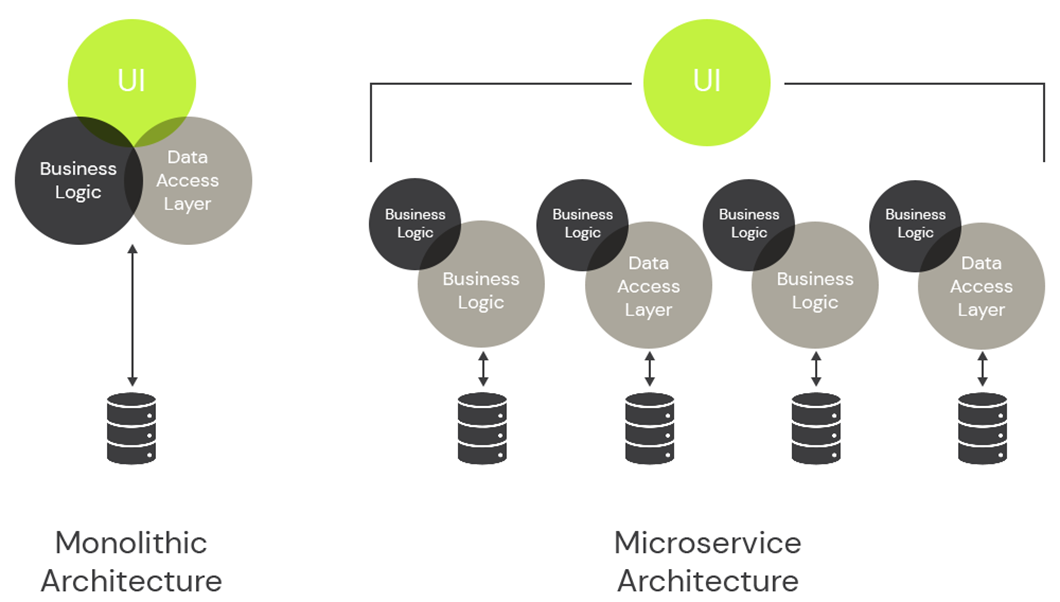

The 'microservice' architecture is about decomposing large and complicated platforms into smaller, more manageable pieces. Each piece can be handled independently by different teams, accelerating the development process while enabling adaptability. The microservice architecture entails backend services, data storage and the frontend(s).

Pros and cons of micro frontends in Banking

Pros

Accelerated Development

With a microarchitecture in place, various teams can work on different features simultaneously, quickening the development process. In a fast-paced digital world, this capacity for swift feature rollout and enhancement is invaluable.

Greater Ownership and Efficiency

Micro frontends can help teams achieve higher efficiency and take full responsibility for their work. Each team focuses on a single piece of the puzzle, leading to enhanced ownership and accountability. A prerequisite for this is that the organization is willing and able to grant autonomy to each team and to the largest extent possible avoid dependencies between teams.

Flexibility

Micro frontends offer the freedom to choose the best technology for a specific part of the application. Each team can select the technology stack that best suits the functionality they are responsible for.

Cons

Initial investment

The initial investment related to implementing a microservice architecture is likely higher that the traditional monolith. Moreover you might need to invest in upskilling current employees or partner with experts as the competencies needed to implement this correctly are different from traditional architectural tasks.

Communication Complexity

Breaking a system into smaller parts requires these components to communicate effectively with each other. Achieving smooth intercommunication can be a complex task, demanding careful planning and organization. In order to manage you need to decouple teams to the largest extend possible and use versioned API’s and data contracts for data exchange.

Potential for Code Duplication

Micro frontends can potentially lead to duplication of code and reloading of code bundles for each separate piece. For users with slower internet connections, this could impact their experience negatively.

Requires a Paradigm Shift

The implementation of micro frontends not only demands a shift in technology but also a change in mindset. Teams must be open to initially compromising on some technical aspects, with the aim of improving upon them once the project scales up.

Governance is a must

Having different frameworks at play can increase efficiency and flexibility short term, but if it goes unchecked it can increase complexity and ultimately increase maintenance cost. Our recommendation is to exploit the flexibility when working with proof of concepts (PoC’s), and thus harvest learnings quickly and cheaply. When a PoC is deemed successful it must be rebuild in the company-chosen framework.

How micro frontends could shape digital Finance

In traditional digital banking, altering one feature could affect the whole system. Micro frontends alleviate this issue by breaking the system into smaller, separate pieces that can be modified independently.

However, proper design decisions are critical to ensure a successful transition to micro frontends. Considerations like how to separate the system, how the parts communicate and coordinate, and how to test and launch each part are vital.

Despite these challenges, micro frontends can greatly improve how financial institutions develop and maintain their digital platforms. They enable more rapid, flexible, and efficient development, which ultimately leads to improved user experiences.

Microservice architecture is seeing headwinds

Microservice architecture is experiencing some headwinds mainly due to Amazon’s Prime video service which rolled back from cloud computing. While microservice architecture offers numerous benefits like scalability, agility, and flexibility, it may not be suitable for every organisation or every project – it is one of the most complex architectures and needs to be carefully managed.

Adopting microservices without careful consideration can lead to a significant increase in costs. Fragmentation and complexity can arise if not properly managed, leading to challenges in monitoring, testing, and debugging. Moreover you can end up seeing a degradation of your performance, if the solution is not designed correctly.

Adding to the last point, a lot of the criticism stems from the first movers that applied the architectural pattern without much thought about when and if it made business sense. Additionally, implementing microservices typically requires a cultural shift and organisational restructuring, which can be challenging for some companies. However, when applied thoughtfully, and tailored to optimise costs in the cloud, microservice architecture can be a valuable addition to the technical roadmap of banks and insurance companies, enhancing their ability to adapt, innovate, and scale in a rapidly changing digital landscape.

Conclusion

01.

In conclusion, the fast-paced world of digital finance is always changing. In this environment, modern CIOs have to keep pace. Microservices and micro frontends offer a way to balance business needs while addressing technical considerations. The ability to adapt quickly to changing circumstances is a key benefit of this approach.

02.

It's important to remember, however, that no one solution can solve all problems. Like any other approach, adopting micro frontends will come with its own set of challenges and areas of concern. Yet, the strengths of this approach - quicker time to market and more business flexibility - make it a compelling consideration.

03.

The successful adoption of micro frontends is dependent on a willingness to engage in constant learning, adjustment, and improvement. It's about seeing potential issues as opportunities to refine and enhance the system. It's also about appreciating that this approach doesn't promise perfection, but rather provides a pathway for continued growth and adaptation in the face of a changing digital landscape.

04.

So, while micro frontends aren't a cure-all solution, they provide an effective tool for tackling the ongoing balance between business innovation and technical architecture integrity. For the modern CIO, this balance is crucial to the successful digital transformation of any financial service company.

How are you handling the changing digital landscape?

We are helping several clients in BFSI to enable their legacy systems and processes to integrate new technologies while maintaining security.

Call or write to Engagement Director, Esben Højmark Gimbel.